Momentum Investing: Worst Months and what Happened Next

Successful Investing: Stay Disciplined

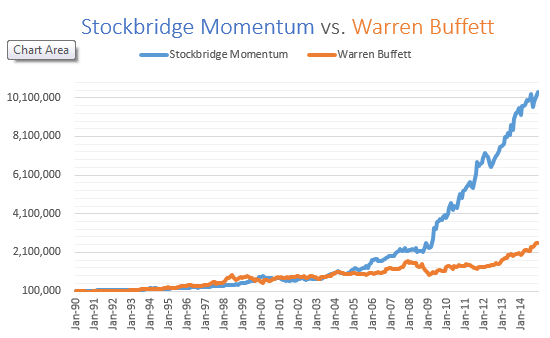

I was re-reading an awesome investing classic “What Works on Wall Street” where he discusses the simplicity and effectiveness of the “Dogs of the Dow” strategy. The author goes on to explain that there were times of the strategy’s under-performance, yet for the disciplined investor who followed the strategy through the bad times, the investor was ultimately rewarded.

In the same light, I asked:

Q: What were the 6 worst months of the Global Asset Momentum Strategy back-test? (starting in 1990)

and more importantly

Q: What happened in the following 12 months?

Below is the table with the answers:

| Month-Year | Month % | Next 12 Months | Event |

| May-10 | -7.80% | 29.90% | Flash Crash |

| Nov-07 | -7.81% | 7.40% | Financial Crisis |

| Jan-09 | -8.47% | 61.80% | Financial Crisis |

| Apr-04 | -8.68% | 14.20% | Unidentifiable |

| Jun-08 | -8.90% | -25.20% | Financial Crisis |

| Aug-90 | -12.96% | 2.50% | Invaded Iraq |

| Average: | -9.10% | 15.10% |

The worst 6 months range from -7.8% to the worst of -13% (averaging -9%). The return of the strategy over the next 12 months averaged 15.1%. They were all positive “next-12-months” except for the June 2008 to July 2009 when the strategy was still climbing itself out of the Financial Crisis.

One interesting observation: 3 of the worst 6 months occurred within 14 months of each other: November 2007…June 2008…January 2009. That’s not to say that we wouldn’t expect poor performance to clump together again in the future, but it appears that on average, the back-test shows it’s fruitful to “stay-the-course”, even when we see a loss of -8% in one month. This is just a repeat of what successful investors already know: invest with discipline and be rewarded.

Eric Ludwig is a certified financial planner in Madison, WI primarily for a select group of successful professionals and business owners, who among other things aspire to a work-optional lifestyle. Stockbridge has developed and refined a process to put all the pieces of that puzzle together and we call it the Stockbridge GPS process. GPS stands for Goals, Planning, Strategy.