Our investment portfolios are carefully designed to help retirement investors reduce risk, improve returns, and create a reliable income stream.

There are three key principles we follow to help protect your nest egg:

1.) KEEP COSTS LOW

The best predictor of future returns is the cost of your investments. In other words, low-cost investments are expected to provide better returns than high-cost investments.

For that reason, we build our retirement portfolios using ultra-low-cost index funds. This helps to improve the success rate of your retirement plan and reduce unnecessary risk.

2.) OWN TAX-EFFICIENT INVESTMENTS

Warren Buffet says his favorite holding period is forever. We agree.

While buying an investment and holding it forever isn’t practical for most retirees, we create portfolios with “low turnover.”

Every time an investment is bought or sold (i.e “turned over”), costs are incurred. Not just obvious costs like transaction fees and taxes, but hidden costs like bid-ask spreads.

These costs eat away at your investment returns. To protect your investment returns and mitigate taxes, we target investments with low turnover.

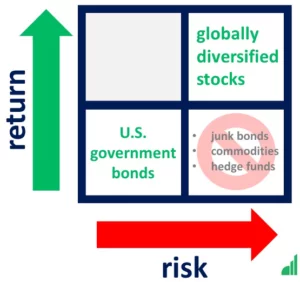

3.) OWN THE RIGHT ASSET CLASSES

Not all investments are created equal. Just because you can invest your money into something (e.g. Gold), does not mean you should.

We only invest in asset classes that:

- Have been proven through academic research to provide superior risk-adjusted returns

- Work well when invested together in a diversified portfolio (e.g. low and/or negative correlation to each other)

For example, corporate bonds can behave like stocks during catastrophic events. That does not provide the diversification needed by a retirement investor.

As a fiduciary, our job is to make investment decisions that are in your best interest. This means ignoring the daily headlines and sticking with evidence-based solutions.